What’s Behind the Green Door?

Back when I served in the House (1999 – 2005), I’d hear a lot of talk about the “Green Door Committee.” Somehow I pictured that these old-time, cigar smoking legislators made their final deals in a secret upstairs room located in the recesses of the Gold Dome behind an old wooden door peeling with green paint. But no. This week the historians of the hallways told me the Green Door Committee was named after a song entitled “The Green Door” from the 1950s — a song about prohibition-era restaurants using green doors to signal their conversion to a speakeasy after hours.

Green door, what’s that secret you’re keepin’?

Wish they’d let me in so I can find out what’s behind the green door.— “The Green Door,” song by Jim Lowe, 1956

My former colleague and member of the Green Door Committee, Rep. Tom Buck, explained it in a 2010 interview:

There were probably about 10 to 12 of us on that. And we would meet behind a green door, as the media called it — the Green Door. But it was really behind Tom Murphy’s office in a conference room where we’d sit around a table, and I think he liked to call it the Policy Committee. It really wasn’t a committee. But your leaders like your chairman of the Ways and Means, Appropriations, University System, and whatnot, would get together at the beck and call of the boss, who was Tom Murphy. And we’d sit there and go over certain things that we liked about what was going on here or what we’d better not do over there. And you could get a lot done with a smaller group. Even though it probably was not wide-open. You know, nobody could just walk in the green door room without permission.

It may not be called “the Green Door Committee” anymore, but this weekend at the Capitol I guarantee you that small groups of House and Senate leaders are privately deciding the fate of both the budget and several high profile bills.

Coming Down to a Nail-Biter

In our last full week of session, bills were popping out of committees like fireworks on the 4th of July. And we’ve had long floor sessions to get as many as we could over the finish line. But in order for that to happen, the Senate and the House must ultimately give the green light to the same bill version, so bills can take lots of twists and turns before becoming final. Decisions made by those “Green Door Committees” keep us on the edge of our seats.

Mental Health Bill Causes a Bit of Anxiety

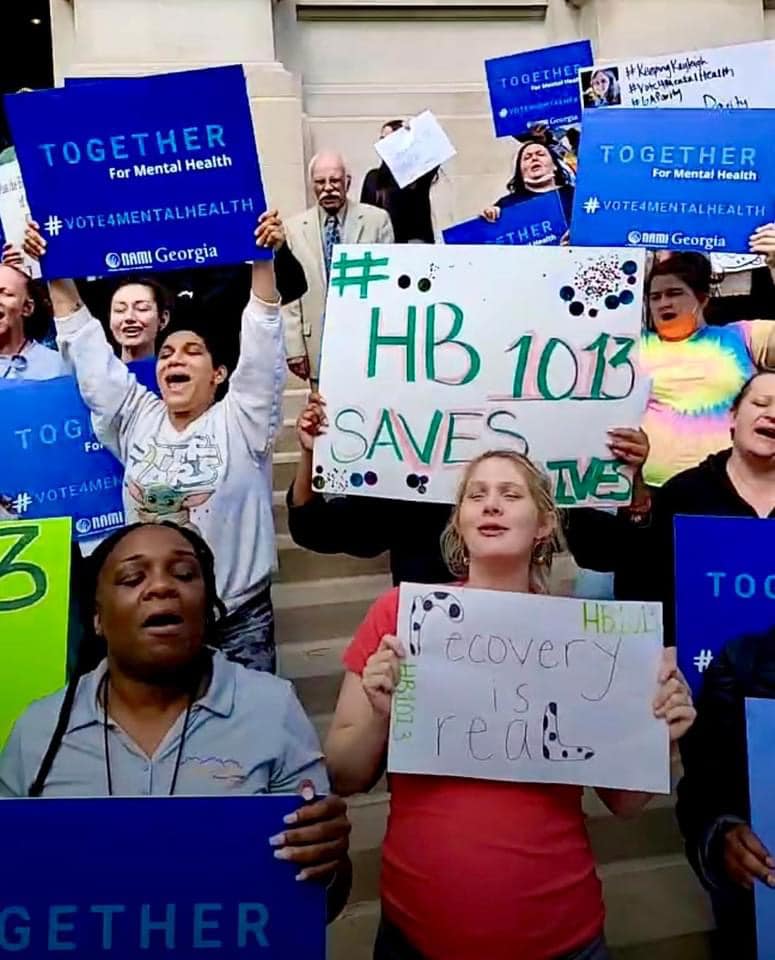

On Monday, the Senate Health and Human Services Committee finally passed HB 1013, Speaker Ralston’s mental health bill. But at the last minute I heard distressing news that the Senate version weakened the bill by creating an insurance company loophole you could drive a Mack Truck through.

Fortunately, by the time the bill came to the floor some “Green Door Committee” somewhere took that out and the Senate unanimously passed the bill with standing ovations from both chambers. I heard that Speaker Ralston got emotional when he heard that the Senate had finally passed the bill. It was the high point of the session. Even in these divisive times, we still came together to address at least one issue that really makes a difference to the people of Georgia.

SB 610 (my bill) Teeters on the Brink

Last week, I wrote about SB 610, my bill that addresses the wages of workers who take care of people with disabilities. But I left you with a cliffhanger when the bill got referred back to the House committee late last week for HB 1404 and another amendment to be attached to SB 610. This is the kind of stuff that is left out by lessons on “how a bill becomes a law.”

It was important for me to show up early to this repeat committee meeting. There I found committee member Rep. Erick Allen, who is a Democratic candidate for Lt. Governor, arguing furiously with a very persistent lobbyist who wanted a “bad” amendment added to my bill. At issue were criminal background checks for substance abuse treatment centers. What Rep. Allen and I both know is that people who have recovered from addiction (and who could have criminal records) are often utilized as trained counselors at substance abuse treatment centers. The lobbyist had narrowed the amendment to attempt to target only the truly bad actors, but Rep. Allen was still not happy.

After an impassioned argument by Rep. Allen, the HB 1404 author rejected the bad amendment and my bill passed with only HB 1404 attached— a measure that would allow private psychiatric hospitals to accept Medicaid.

In the end, my bill carrying HB 1404 sailed through and passed the House unanimously. Now it only needs an “agree” by the Senate and the Governor’s signature to become law. I am proud to address both the wages of workers AND access to private psychiatric hospitals by Medicaid recipients in need.

As an end-note, the lobbyist who tried to attach the problemattic amendment to my bill did not give up. I found him at the ropes trying to target another Senator’s bill just before it came up for a vote in the Senate. That didn’t work either.

Bad Voting Bill Gets Gutted — Or Does it?

It has always bothered me that the Senate Ethics Committee never heard feedback from election administrators last year when they passed the big voting bill, SB 202. That changed this week when election officials from at least a dozen counties from all across Georgia testified against HB 1464 — this year’s election bill. Nearly 50 people signed up to speak at a hearing that lasted more than three hours. The vast majority told us that the proposed requirements would be onerous and expensive, making it harder to hire and retain elections staff. Many though, spoke in favor of one provision that required employers to allow their employees time off to vote during the Early Vote period (current law only requires employers to give time off on Election Day).

In preparation for the vote the next day, I asked my administrative assistant Keridan to track down and print the bill substitute I knew was coming. When she placed it in my hand, I could feel that something big had happened. The bill went from 40 pages down to only two, with the lone remaining measure being the one good provision — time off work to vote during Early Voting. At that moment, a huge weight lifted off my shoulders. I didn’t have to fight yet another bad voting bill! For me, it was the single best moment of the session.

Although the bill substitute passed the Senate Ethics Committee unanimously, several of my Republican colleagues were disappointed, to say the least, that some of the original provisions were gutted, a sure sign those provisions could reappear later. Will HB 1464 pass the Senate floor as is, or will they amend it in Senate Rules? Will the bill end up in a Conference Committee where six specially appointed legislators from the House and Senate decide its fate? Stay tuned!

By the way, I’m hearing that the gutting of the bill can be attributed to Lt. Governor Geoff Duncan. I am currently reading his book “GOP 2.0,” which I highly recommend.

Will Georgia Get a New Tax Code?

Another major bill making its way through the General Assembly overhauls Georgia’s income tax system. The original House Bill, HB 1437, proposed a regressive flat tax of 5.25%. But early in the week, the Senate Finance Committee made significant changes that includes a longer, more gradual transition to a flat tax (down to 4.99%), an Earned Income Tax Credit that would help middle and low income families, and a provision that changes only take place if state revenues increase by at least 3%. The Senate version also included substantive changes to Georgia’s film tax credits, but the film industry pushed back and that change was dropped from the bill before it came to the Senate floor.

Georgia’s system of taxation has essentially remained unchanged since 1937 — that is, until a change in 2018 reduced the 6% rate to 5.75% (approximately $500 million out of a $30 billion budget). The 2018 change was supposed to be the first step of a two-step reduction, eventually bringing the rate to 5.5%. The second reduction never happened because a projected windfall from the 2017 Federal Tax Code revisions never surfaced.

I voted against this bill. Although the Senate version made significant improvements to the House Bill, I just don’t see why Georgia’s rate of taxation needs to be changed. Georgia has always been and still is a fiscally conservative state. I believe that Georgia has reached the point of what I call “negative efficiency.” This is when so little is being spent that the money that IS being spent is no longer as effective as it could be. The tax savings for most Georgia families will be vastly oustripped by the cuts to services many of us use. And I don’t believe it’s an accident that this major reduction in revenue is being enacted just before the election of a Democrat to the Governor’s office is within reach.

The House will now have to agree to this version or insist on its original proposal. If it insists, a Conference Committee will be appointed to work out differences and with one more legislative day to get it done, Georgia’s tax system hangs in the balance.

Cityhood Suspense

Given a few news stories last week, you might get the impression that I’ve suddenly introduced a new cityhood proposal. But the media simply picked up on some work that’s been ongoing for several years.

During the past two years, I’ve spent time researching how forming another city in north DeKalb can help protect DeKalb County Schools from costly annexations by cities that have their own school systems (Decatur and Atlanta), as well as shoring up public safety resources county-wide. This year, I spent much-needed time discussing the proposal with my colleagues in the Dekalb Senate delegation to get their input.

This is all still in the proposal stage — there is no bill yet. I plan to hold community meetings to get input from those in the map footprint. Some have asked specifically about the Evansdale area. The reason the area outside the perimeter is not currently in the map is because of the need to preserve choices among several options. These are among the discussions I look forward to having in the coming months.

Sine Die Cliffhangers

Monday is Sine Die — the last chance for legislative action on bills still at play. There are so many bills still waiting on the table, but which ones will make it across the finish line?

You can tune in to Sine Die livestream on Monday starting at 10 am in the Senate on the General Assembly website. Or stay tuned for “Sally’s Senate Snapshot Sine Die Edition”! Or, attend the TownHall described below.

Post Sine Die Town Hall

Another way to learn about the final outcome of the 2021/2022 session is to join me and fellow SD 40 House Representatives at a virtual town hall meeting on Wednesday, April 6th at 7 pm. Thank you to the City of Chamblee for hosting! Register here for the event and we will send the Zoom information to all registered attendees.

I was pleased to see these people at the Capitol so happy about the passage of HB 1013, the Mental Health Parity bill

The “Ropes” are open again but without a Student Page Program. This is a dream come true for Corporate Lobbyists, who only need a cell phone number, not a page, to call us “out to the ropes.”

What do you ask for when you see these two men together? Senate Appropriations Chair Blake Tillery and House Appropriations Chair Terry England.

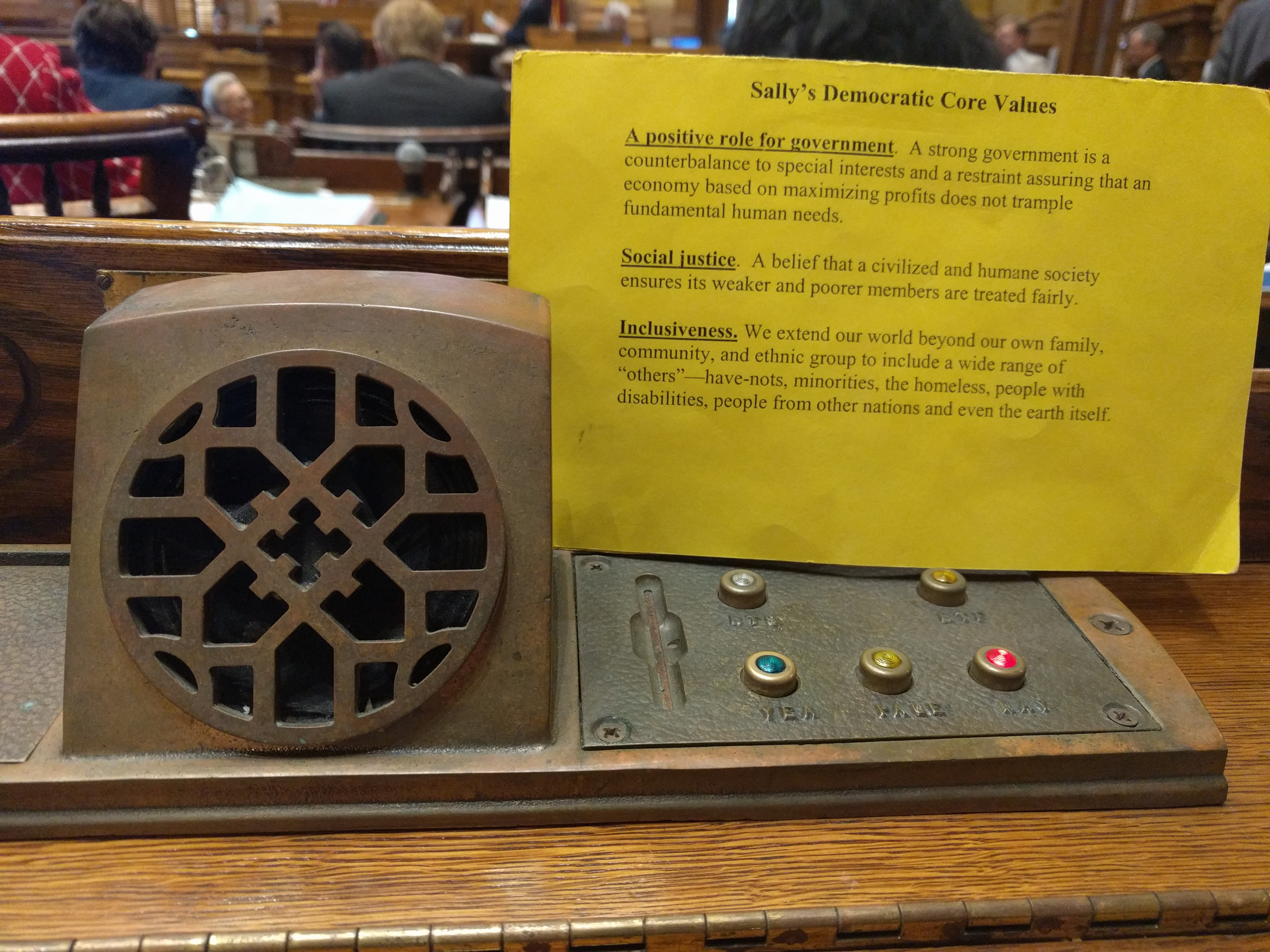

I got my Yellow Card of Values back out to guide me during the final days of the session. Things can get really confused at this point, and I need some guidance

It was a full house in Senate Ethics for a 3+ hour hearing on this year’s election bill. It was great to hear from over a dozen election administrators, but we had our share of election conspiracy theory folks too

The Mental Health Parity bill could not have passed without the efforts of these two lobbyists, Kim Jones of NAMI and Jeff Breedlove of the GA Council on Substance Abuse. They also helped me fight the “bad” amendment to my HB 610